Wint Wealth Review

Today, there are many platforms that allow you to buy bonds and make investments in different avenues. It is important to understand all the pros and cons of these platforms and how much risk is involved in using them. We have done a detailed breakdown of Wint Wealth, so you can have utmost clarity about it. Let us get started with understanding what type of platform Wint Wealth is.

What is Wint Wealth?

It is a platform for NBFCs (Non-Banking Financial Companies) to raise financing. It gives its consumers a list of assets and a solid set of returns on their investment. Wint Wealth provides senior secured bonds from various firms directly to the consumer. Wint Wealth has created covered bonds for retail investors, which offer increased security. In this Wint Wealth review, let us go over some of the features provided by Wint Wealth.

Fixed/consistent returns. Use of physical collateral, such as gold, real estate, or automobiles. Framework for bankruptcy protection. Low Investment Requirements.

Let us understand what a senior secured bond means. Basically, the bond is like a fixed asset. Financial securities such as bonds are owed money by their issuers to their buyers. It is the issuer’s responsibility to repay the principal amount and interest over time. A bond is of two types:

Unsecured bonds are the ones where no security is included in the deal. If the firm ceases operations, you have very little prospect of collecting your primary funds from the company. A secured bond is one that has adequate security backing. As a result, if the firm fails, you have a better chance of receiving your capital back.

Finally, senior secured bonds imply that in the case of the company’s liquidation, the senior-most secured bondholders will recover their investments first. The Senior Secured Bond issued by Wint Wealth is solely based on this strategy.

Features of Wint Wealth

There are many features that make Wint Wealth the best platform for investors. As promised we will go through each feature of Wint Wealth in this Wint Wealth review.

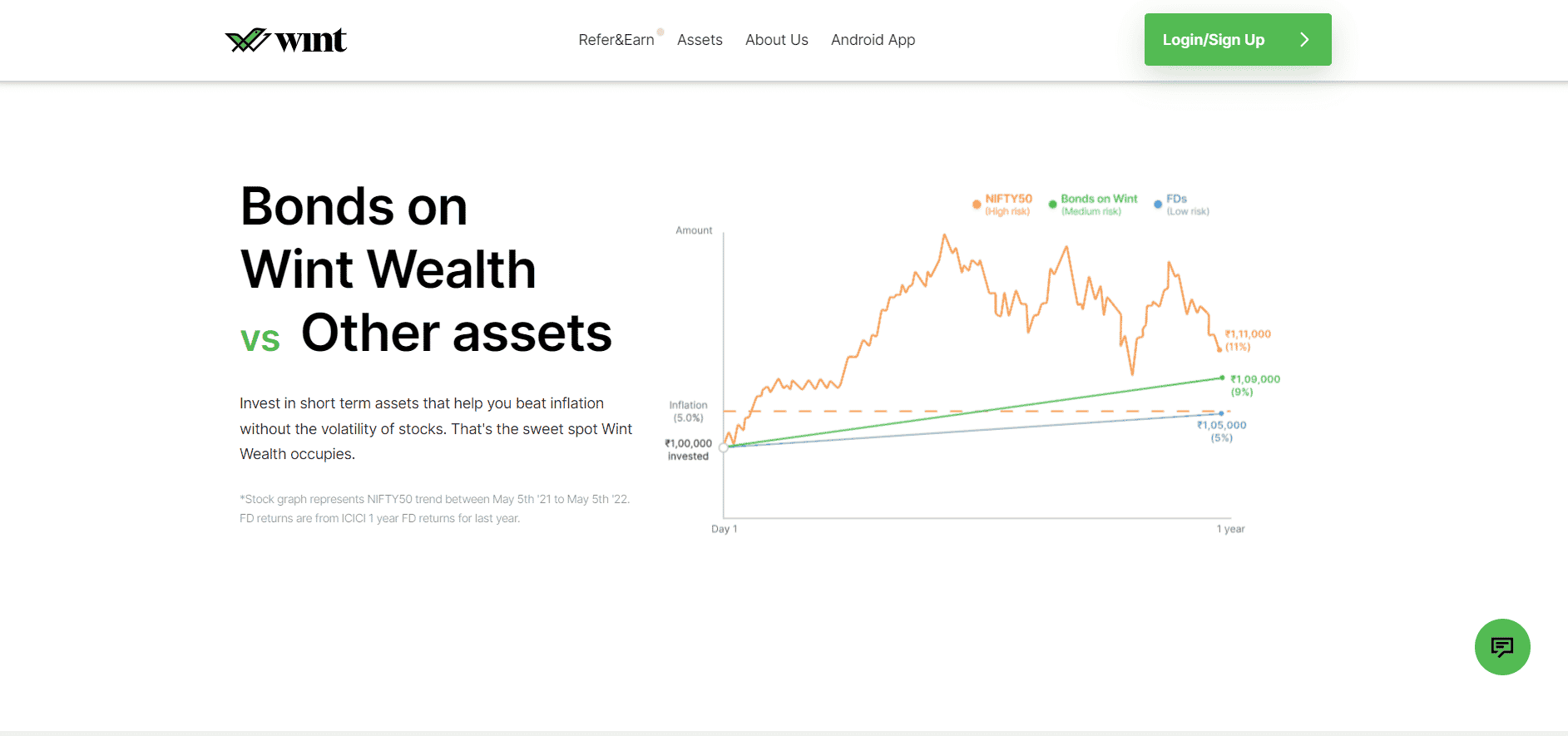

- Returns are higher than Fixed Deposits The constant decline in the returns on fixed deposits has led to the rise of Wint. A Senior Secured Bond is comparable to an FD since it is a safe and secure fixed-income asset. They do, however, provide substantially higher returns than FDs, averaging 9% to 11%.

- Investments are secure on the Platform Due to the numerous financial industry frauds, buyers are often afraid to make direct investments. To combat this, Wint screens out the top businesses and only offers investors the most secure choice.

- Minimum Risk Senior secured bonds from Wint Wealth carry a fraction of the risk that the stock markets do. Wint’s investment products may be your best option if you have a low-risk tolerance or want to avoid losing your primary investment.

- Small Ticket Size In contrast to conventional bond investments, Wint allows ordinary investors to engage in these fixed-income products for as little as Rs. 10,000. As a result, you don’t have to spend a large quantity on these assets and may begin with a small investment to earn significant returns.

Benefits of Wint Wealth

Let us continue our Wint Wealth review by analyzing some of its benefits.

- Diversification If you are interested in investing, you undoubtedly know that diversifying your portfolio is important. You are protected from unforeseen stock market catastrophes because of this diversification. Senior Secured Bonds allow you to diversify your portfolio by purchasing debt with a set yield.

- Shorter Duration These bonds offered by Wint Wealth offer returns over a shorter length of time, just two years, in contrast to other FDs and bonds that offer returns over a longer period, often around five years.

- Affiliation with Stock Markets Bonds that are available for investment on Wint’s platform are frequently listed on the stock exchange. This offers these instruments a ton of liquidity.

Is Wint Wealth safe?

If you are investing in any platform, you need to know what is the risk that might be involved with that platform. We can’t complete this Wint Wealth review without answering this important question, is Wint Wealth safe? Some of the risks involved with Wint Wealth are as follows:

- Risk of Crime by Hackers Nobody can predict when fraud may affect a person. It has been reported that many people have been defrauded of thousands of dollars in the past. The same may be said about people’s confidence in these ties. Wint uses a variety of techniques to provide these bindings with complete safety. First of all, they carefully choose each and every relationship. Wint only brings in low-leverage enterprises.

- Risk of Losing Credit Investors frequently worry that, in the event the startup fails, their money will be lost. These investors have frequently suffered significant losses as a result of the unsecured bonds. By allowing only businesses with surplus security pools to cover their raised money on their platforms, Wint Wealth eliminates this danger. You may even choose to amortize bonds, which would allow you to conveniently get your principal back in payments over a certain period. Now you know, is Wint Wealth safe? There is enough proof to conclude that the platform is reliable and operates in investors’ best interests. It has the support of dedicated individuals. The website goes to great lengths to inform investors about the deals it offers for investment. When evaluating the bargains on Wint Wealth, it is essential to compare them to other products that provide comparable returns. All upcoming transactions on Wint Wealth will be public issues, which means that SEBI regulations apply and the platform must adhere to the necessary procedures. The covered bond feature gives the assets an additional degree of security above comparable NCDs on the secondary market!

Wint Wealth Fees

It is absolutely free to open your account with Wint Wealth. You need to have an account with a SEBI registered broker to get your account. In the case of assets with a fixed interest rate return of 12-14%, they will reduce your interest rate by about 2%. Now in this Wint Wealth review, let us compare Wint Wealth vs Golden Pi. It will give you a better understanding of how Wint Wealth stands in front of its competitors. Also Read: How to Use CRED Coins to Cash?

Wint Wealth vs Golden Pi: A Comparison

The company Zerodha has only released one trading platform called Golden Pi, allowing traders to start trading fixed-income investments. With Zerodha Golden Pi, traders can choose between bonds from major bond institutions, corporations in the capital market, and bank capital market divisions. Here are some differences between Golden Pi and Wint Wealth.

The bonds available in Wint Wealth are more diversified to reduce risk factors unlike in the case of Golden Pi. There is a fixed income in the case of Wint Wealth, with very low risk and highly regulated bonds. Golden Pi offers returns of up to 13.5% on more risky bonds. You get to choose bonds as per your risk appetite with Golden Pi. There are three levels of bonds, which range from high-security with low returns to high returns with low security. In the case of Wint Wealth, security and reducing risks in bond investments are what the customers seek. Therefore, the returns remain 9-11% with a highly secure investment experience.

Given below is a table comparing Wint Wealth and Golden Pi so you can decide if Golden Pi can work as a Wint Wealth alternative or not.

Wint Wealth Alternatives

After comparing Wint Wealth and Golden Pi, let us introduce you to some more alternatives of Wint Wealth in this Wint Wealth review. Numerous platforms are available that may be used in addition to Wint Wealth. One platform that gives access to leasing investments and offers 13–15% IRR is Grip Invest. TradeCred, which operates as a marketplace for invoice discounting, is another alternative to Wint Wealth. People may also look at Klubworks for financing that is dependent on income. Both Lendbox and Cashkumar have developed intriguing solutions with consistent returns and no risk. Wint Wealth is a fantastic tool for ordinary investors to diversify their holdings. A majority of investors’ portfolios contain a sizable portion of fixed deposits, which provide returns below inflation. Investment in platforms like Wint Wealth increases asset returns altogether and diversifies them. In this Wint Wealth review, we have tried to cover every aspect of Wint Wealth. We have answered is Wint Wealth safe? So that you can be aware of the risks involved with Wint Wealth. We also did a Wint Wealth vs Golden Pi comparison and concluded our review by providing you with some Wint Wealth alternatives.