It is estimated that Indian consumers have hoarded more than 20,000 tonnes of gold over the centuries and most of it lies idle in bank lockers across the country and does not contribute to the growth of the Indian economy. This scheme also aims to reduce the amount of gold that is imported and smuggled into India every year by recycling the existing gold held by consumers to Jewelers and Mints.

The 3 Gold Schemes that were launched as part of Swarna Bharat are:

Indian Gold Coins Gold Monetization Scheme Sovereign Gold Bonds

Given below is a detailed explanation of how you can benefit from these schemes and the procedure that is required to be followed for buying India Gold Coins, opening a Gold Deposit Savings Account and subscribing to Gold Bonds.

Scheme No 1: India Gold Coins

For the first time in its independent history, India has minted a gold coin as part of the Gold Monetisation program. The 24 Karat pure gold coin features India’s national emblem the Ashoka Chakra on the front side and the face of Mahatma Gandhi on the rear side. The coin is available in 3 denominations and is being minted in limited quantities initially and more may be manufactured in the coming months depending on consumer demand. Pricing of Indian Gold Coins

5 gm Indian Gold Coin – Total Quantity: 15,000 coins – Price Rs 14,600 10 gm Indian Gold Coin – Total Quantity: 20,000 coins – Price Rs 28,900 20 gm Indian Gold Coin – Total Quantity: Unavailable – Price Rs 57,600 Gold Bullion (Bars) – Total Quantity: 3750 – Price – Not Yet Available

Note: Prices are exclusive of VAT which is charged in many states at 1% of the total value of your purchase.

Features of Indian Gold Coins by MMTC

It is made of 24 Karat Gold. It is made in India as per BIS Standards by Metals and Minerals Trading Corporation of India (MMTC) which is a public sector company. It has Tamper-proof packaging which ensures it cannot be duplicated and can be easily sold when you require money urgently.

A picture of India Gold Coin is given below, this is a sample image only and is not to be scaled.

So should you purchase this coin from the MMTC outlets in your city?

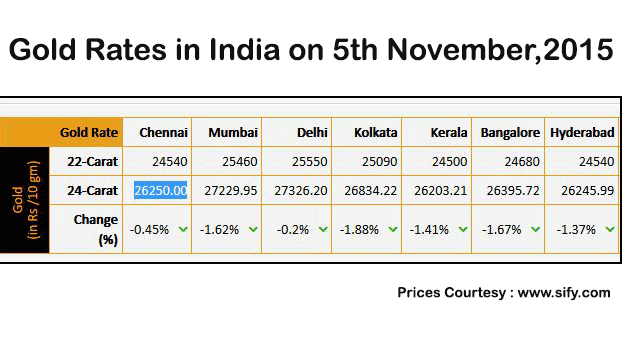

The current price of gold on 5th November is Rs 26,250 for 10 gms of gold. The gold coin is priced at a rate that is 10% higher than the prevailing market rate. However, because of the limited quantity and hype surrounding the scheme, it is expected to fetch more value as time passes. Its the price is expected to rise over the years as Indians have an insatiable demand for gold, so it is a good investment and might fetch hefty premium decades from now provided it is minted in limited quantities.

Where can you purchase Indian Gold Coins?

India gold coins are currently available only at MMTC outlets across the country. The cities where these outlets are based are given below:

Ahmedabad Barbil Bellary Bengaluru Bhubaneswar Chennai Goa Hospet Hyderabad Jaipur Kolkata Ludhiana Mumbai New Delhi Puri Visakhapatnam

If you are located in Mumbai, Raipur or Mysore you might not be able to purchase these coins. Also, the ability to book or purchase Indian Gold Coins online has not yet been made available, so you will have to visit a store and purchase it physically. The addresses of different stores spread across the country are available on the following website. http://www.indiangoldcoin.com/en/

Scheme No 2: Gold Monetization Scheme (Gold Savings Account)

Features of this scheme

This unique scheme will allow Indian citizens to deposit their existing gold holdings with Banks who will in turn pay an interest rate of up to 2.5% per annum on the value of the gold. When you deposit the gold you will receive a certificate of deposit.

Terms of the Gold Savings Account Deposits

Select Indian banks will accept gold deposits for 3 Different Term Periods.

Short Term Gold Deposit Scheme which lasts from 1 to 3 years. Medium Term Gold Deposit Scheme which lasts from 5 to 7 years. Long Term Gold Deposit Scheme which lasts from 12-15 years.

Note: The interest rate paid is highest on long term schemes which are a maximum of 2.5% per annum. The list of banks authorized to open the Gold Deposit Savings Account is not yet available but it is expected that the State Bank of India, Canara Bank, HDFC Bank, ICICI Bank, Bank of Baroda, Bank of Maharashtra and all other major banks will be a part of this scheme.

Benefits of this Scheme

Storing gold in bank lockers costs money in the form of annual charges and security deposit which has to be paid to the bank. If you store gold at home, there is always a security risk that it might get stolen. This scheme helps gold owners save money in terms of storage costs and also helps to secure their investments. When you deposit the gold with the bank in gold savings account you will earn 2.5% interest on the value of the gold. The interest paid will change as the value of gold changes in the market. If the price of gold increases over time then the interest paid will also increase proportionately hence your earnings will be linked to the floating gold price. The other main benefit of this scheme is that your earnings from the Gold Savings Account are exempt from capital gains, wealth and income tax. You are not required to pay any capital gains tax on the appreciation in the value of gold deposited or on the interest, you receive from it.

Procedure for Depositing Gold under Gold Monetisation Scheme

The minimum amount of gold that you can deposit is 30 gms, there is no maximum limit. First, you will need to verify the purity of the gold. This is done through collection and purity testing centers recognized by the Government of India. After it’s purity is verified you will receive a purity certificate and you can proceed to deposit it at the nearest bank.

Currently, most of the Gold Purity Centers are based in West and North India

The following cities have recognized gold purity centers The addresses of the various centers can be found on the Ministry of Finance Website : http://finmin.nic.in/swarnabharat/gold-monetisation.html There are no purity testing centers for the states of Karnataka, Telangana, Andhra Pradesh, Orissa and Tamil Nadu mentioned in the above list. This makes one wonder if this just a Diwali gift for Gujarati’s and Marwari’s of North India who has supported Narendra Modi into Power? What is notable is that important capital cities like Bangalore, Hyderabad, Chennai and Bhubhaneshwar which are ruled by parties opposed to the BJP have been left out from this scheme. Let us hope that more purity testing centers are opened in the south of India which is one of the largest consumers of gold in the country. You can take your gold in any form to these centers and they will assess the gold in front of you and provide you with a certificate on purity and gold content, then you can decide to deposit the gold in any one of the schemes.

What will the Banks and Government do with the Gold you deposit in your Gold Savings Account?

The government plans to melt it and reissue it as India Gold coins and bullion bars for local consumption as India currently imports 1000 Tonnes of gold. This demand for gold is met by purchasing it from abroad in dollars which leads to a loss in foreign exchange weakening India’s economic health. By recycling existing gold found in bank lockers the government hopes to save on foreign exchange and reduce its import bill.

Eligibility to deposit Gold in this Scheme

This scheme is open to Resident Indians, Hindu Undivided Families (HUF), Trusts and Mutual Funds. The opening of gold deposit accounts at banks will require you to submit the same KYC documents that you would furnish to open a savings account or fixed deposit.

Should you deposit your Gold in this Scheme?

Since banks will sell this gold to MMTC and Jewellers to mint gold coins, you cannot expect to get back your gold in the same form. Hence you can deposit gold coins, unused jewelry and bullion bars but if you deposit your favorite jewelry it is unlikely you will see it again.

Redemption of Gold Monetization Scheme

When your deposit matures you can redeem your gold as .995 fineness gold or accept cash in Indian rupees. You can also withdraw your gold before the scheme matures but there is a minimum lock-in period and a penalty will be imposed. These details are expected to be announced in the coming days.

Scheme No 3: Sovereign Gold Bonds

The Gold Bonds are government securities issued by the RBI on behalf of the Government, it is denominated in grams of gold. Gold bonds are basically substitutes for holding physical gold. Investors have to pay the issue price in cash depending on the prevailing market rate of gold and the bonds will be redeemed in cash on maturity.

Minimum Investment Limit

There is a minimum investment of 2 gms per bond and Indian citizens can purchase bonds up to 500 gms.

Benefits and features of this Scheme

Gold bonds will be issued in Demat or Paper Form. The minimum tenure of the bond is for 8 years with optional exits after 5,6 and 7 years. These bonds can be used as collateral while applying for loans at banks. You can also trade these bonds on Exchanges if you have it in De-materialized form. You will earn interest at the rate of 2.75% on these bonds.

Where can you purchase these bonds?

You can purchase gold bonds at any post office, bank or NSC agent.

Last Date for application

You can apply for gold bonds between November 5-20, 2015 and the bonds will be issued on November 26th, 2015. For more details and answers to other related questions visit http://finmin.nic.in/swarnabharat/sovereign-gold-bond.html All the websites linked in this post provide the complete details in Hindi and English pdf format. If you have any additional comments about these schemes, feel free to ask about them in the comments section below and we will provide you a quick response.